Comparison of Currency Options, Currency Swaps, and Spot Transactions in Foreign Exchange Introduction In international trade and finance, companies dealing with foreign currencies use various financial instruments to manage exchange rate risks. The three main instruments are:

Currency Options - Provide the right (but not obligation) to exchange currency at a fixed rate in the future.

Currency Swaps - A contract to exchange currency flows over a set period.

Spot Transactions - A simple immediate currency exchange based on the current market rate.

While spot transactions offer simplicity, currency options and swaps provide better risk management and flexibility.

1. Currency Options (Flexible Risk Management Tool)

Definition

A currency option gives the holder the right, but not the obligation, to exchange a currency at a predetermined rate on or before a specific date.

✅ Types of Options:

Call Option - Right to buy a currency at a fixed rate.

Put Option - Right to sell a currency at a fixed rate.

Example: A UK importer buying goods from the US purchases a GBP/USD call option to protect against an increase in the exchange rate.

Advantages of Currency Options Over Spot Transactions

✔ Risk Protection - Protects against adverse currency movements while maintaining upside potential.

✔ Flexibility - No obligation to execute the transaction if the exchange rate is favorable.

✔ Ideal for Hedging Future Payments - Useful for businesses with uncertain future cash flows in foreign currencies.

❌ Disadvantages

✖ Premium Costs - Buying options requires upfront payment.

✖ Complexity - More sophisticated than spot transactions.

Best for: Businesses managing currency risk with unpredictable payment schedules.

2. Currency Swaps (Long-Term Hedging Solution)

Definition

A currency swap is a contract between two parties to exchange currency flows over a set period at a predetermined rate.

✅ How It Works:

Companies exchange principal and interest payments in different currencies.

Used to secure long-term financing in foreign markets.

Example: A UK company with a loan in USD enters a GBP/USD swap with a US firm to exchange interest payments, reducing exchange rate risk.

Advantages of Currency Swaps Over Spot Transactions

✔ Long-Term Stability - Protects businesses from long-term exchange rate fluctuations.

✔ Cost Efficiency - Often cheaper than converting currency via spot transactions repeatedly.

✔ Reduces Interest Rate Risk - Useful for companies with foreign currency debt obligations.

❌ Disadvantages

✖ Less Flexible Than Options - The swap contract must be followed as agreed.

✖ Counterparty Risk - Dependent on the financial stability of the other party.

Best for: Companies with long-term foreign currency liabilities (e.g., loans, international contracts).

3. Spot Transactions (Immediate Currency Exchange, No Hedging)

Definition

A spot transaction is a straightforward exchange of currency at the current market rate for immediate settlement (usually within two days).

Example: A European exporter receiving USD payment converts it immediately into EUR using a spot transaction.

Limitations Compared to Derivatives (Options & Swaps)

❌ No Risk Protection - Subject to daily exchange rate volatility.

❌ Not Suitable for Future Obligations - Cannot hedge against expected payments or receipts.

❌ Higher Costs for Frequent Transactions - Repeated spot trades incur forex fees and spread costs.

Best for: Small businesses or one-time transactions with no currency risk concerns.

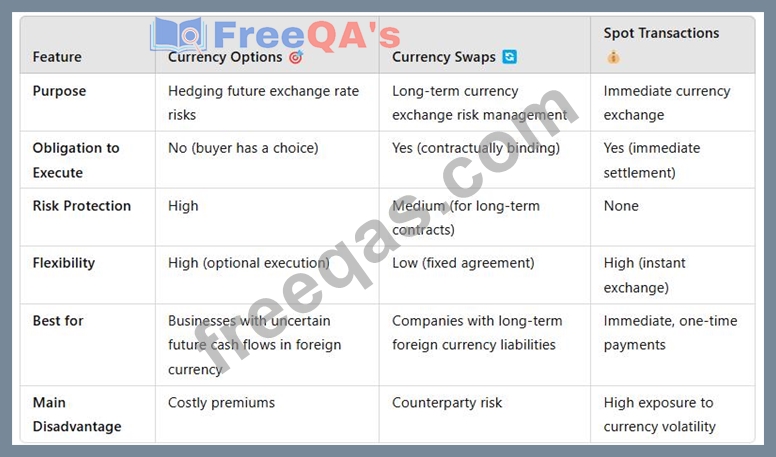

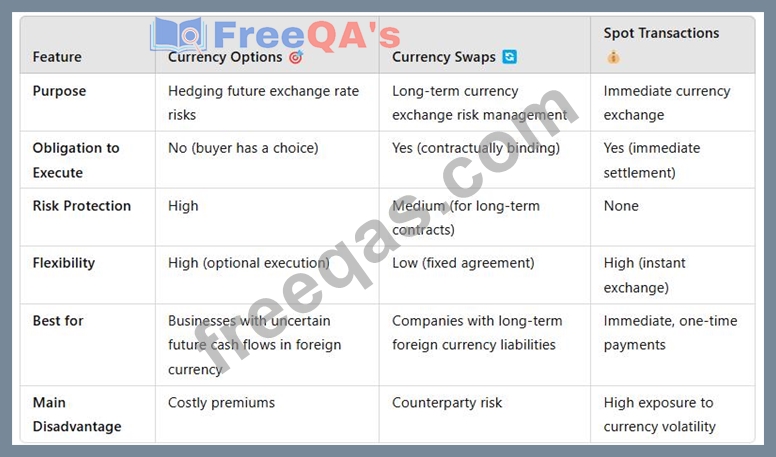

4. Comparison Table: Currency Options, Swaps, and Spot Transactions

Key Takeaway:

Currency options offer flexibility and protection but come at a cost.

Currency swaps provide long-term stability for large corporations.

Spot transactions are simple but expose businesses to market fluctuations.

5. Conclusion & Best Recommendation

For businesses engaged in international trade, investments, or loans, using currency options and swaps is superior to spot transactions, as they provide:

✅ Protection from exchange rate volatility.

✅ Cost efficiency for large or recurring transactions.

✅ Better financial planning and risk management.

Best Choice Based on Business Needs:

For short-term flexibility → Currency Options

For long-term contracts or loans → Currency Swaps

For one-time currency exchange → Spot Transactions

By selecting the right derivative instrument, businesses can reduce foreign exchange risk and improve financial stability.