A new technological improvement is invented for the production of coffee. At the same time, the price of tea (a substitute for coffee) decreases, and the price of sugar (a complement to both coffee and tea) increases. What is the known result for the new equilibrium for coffee?

An asset manager performs a regression analysis of Boeing's monthly returns against the monthly returns of the Standard and Poor's 500 (S&P 500), a stock market index of 500 large companies. Since the financial market is so volatile, the asset manager decides that it is nearly impossible to forecast exactly what Boeing's monthly returns will be and therefore asks the team to provide a range of possible monthly returns for Boeing. The manager wants to cover as many potential outcomes as possible and asks the team to construct a 99.7% prediction interval. Given the regression output below, which of the following options is a reasonable estimate of the 99.7% prediction interval for Boeing's monthly returns, assuming that the S&P 500 monthly returns decline by 3%? Note that percentages are represented as values between 0 and 1.

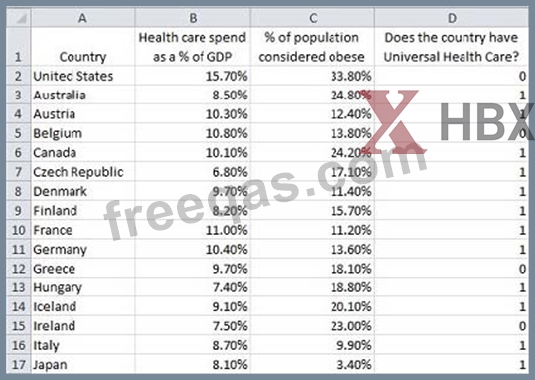

A researcher wants to know the impact that obesity and universal health care have on the amount a country spends on healthcare as measured by the percentage of gross domestic product (GDP). The researcher collects data from 30 countries on the percentage of the population considered to be obese and whether that country offers universal health care to their citizens. A dummy variable is constructed to measure the latter: the variable is set to equal 1 for countries that offer universal health care and 0 for those that do not. The researcher wishes to set up a regression analysis to measure the effects these two variables have on health care spending. A partial view of the data is shown below.

Based on the available data, what ranges should be entered into the Excel regression dialog box for the dependent and independent variables?

A coal burning power plant in upstate New York has been the only provider of power in the region for many years. Recently, a plant that uses wind to create energy was built nearby. The wind plant produces less energy than the coal plant but at a lower cost. Will the coal plant be able to remain competitive in this new market environment?

A company bought a piece of land in 2012 for $200,000. In 2013, the piece of land temporarily reduced in value to $150,000 but then appreciated in value to $220,000. How would the company report this piece of land on its balance sheet for 2013?