An accountant pays $30,000 for inventory purchased on credit last month. This payment will impact the accounting equation by decreasing assets and:

ABC Furniture Store recently hired a new salesperson and wished to examine how that affected the store's daily furniture sales. Prior to the new salesperson's hire, the store averaged $10,000 worth of sales per day with a standard deviation of $1,500. The store's manager took a random sample of 100 days after the salesperson's date of hire and found that the store averaged $11,500 worth of sales per day. Which of the following options would correctly calculate the 95% range of likely sample means for this hypothesis test? Note that the Excel function is: =CONFIDENCE.NORM(alpha, standard_dev, size)

A company collected $10,000 from a customer in payment for goods sold to the customer a month ago on credit. How would the collection impact the accounting equation?

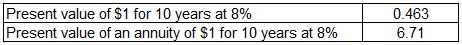

A company buys a machine for $175,000. The machine will be depreciated on straight-line basis over a 10-year period with salvage value of $25,000. The company expects the machine to generate after-tax net cash inflows of $30,000 in each of the 10 years. At the end of the 10 years, the machine is expected to be sold for $25,000. The discount rate is eight percent.

What is the net present value?

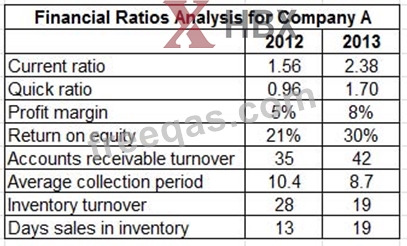

Which of the following statements is NOT true regarding Company A? Exhibit: