An entity has a majority of its customers located in states A and B. A major west coast bank has agreed to provide a lockbox system to the entity at a fixed fee of US $50,000 per year and a variable fee of US $0.50 for each payment processed by the bank. On average, the entity receives 50 payments per day, each averaging US $20,000. With the lockbox system, the entity's collection float will decrease by 2 days. The annual interest rate on money market securities is 6%. If the entity makes use of the lockbox system, what would be the net benefit to the entity? Use 365 days per year.

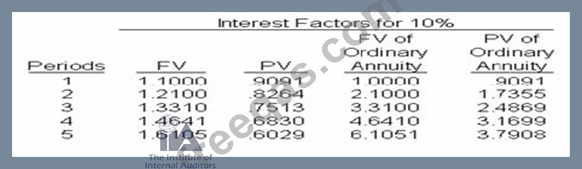

If the amount to be received in 4 years is US $137,350, and given the correct factor from the 10% time-value-of-money table below, what is the current investment?

In a process-costing system, the cost of abnormal spoilage should be:

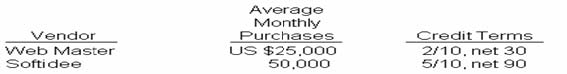

Assuming a 360-day year and that CyberAge continues paying on the last day of the credit period, the entity's weighted-average annual interest rate for trade credit ignoring the effects of compounding) for these two vendors is:

A validation check used to determine if a quantity ordered field contains only numbers is an example of a(n):