Quality cost indices are often used to measure and analyze the cost of maintaining or improving the level of quality. Such indices are computed by dividing the total cost of quality over a given period by some measure of activity during that period for example, sales dollars). The following cost data are available for a company for the month of March. The company's quality cost index is calculated using total cost of quality divided by sales dollars.

Sales US $400,000

Direct materials cost 100,000

Direct labor cost 80,000

Testing and inspection cost 6,400 Scrap and rework cost 16,800

Quality planning cost 2,800

Cost of customer complaints and returns 4,000

The quality cost index for March is:

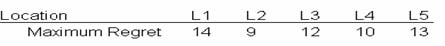

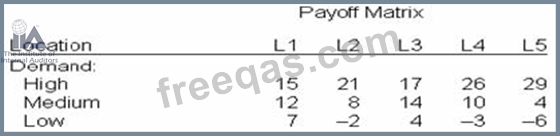

If the bank uses the minimax regret criterion for selecting the location of the branch, it will select.

An organization has an agreement with a third-party vendor to have a fully operational facility, duplicate of the original site and configured to the organization's needs, in order to quickly recover operational capability in the event of a disaster, Which of the following best describes this approach to disaster recovery planning?

The company uses a planning system that focuses first on the amount and timing of finished goods demanded and then determines the derived demand for raw materials, components, and subassemblies at each of the prior stages of production. This system is referred to as:

Company P, which produces computers, uses a target pricing and costing approach. The following is Company P's costs and revenues for the year just ended:

Company P plans to increase sales of computers to 15,000 in the next year by reducing the unit price to US $1,250. If Company P wishes to achieve a unit target operating income of 10%, by what amount must it reduce the full cost per unit?