An organization has decided to allow its managers to use their own smart phones at work. With this change, which of the following is most important to Include In the IT department's comprehensive policies and procedures?

In a <List A> personal tax system, an individual's marginal tax rate is normally <List B> the average tax rate.

For the past several years, Company S has invested in the ordinary stock of Company A.

Company S currently owns approximately 13% of the total of Company A's outstanding voting ordinary stock. Recently, management of the two companies have discussed a possible combination of the N.ro entities. If they do decide to combine, how should the resulting combination be accounted for?

Which type of risks assumed by management are often drivers of organizational activities?

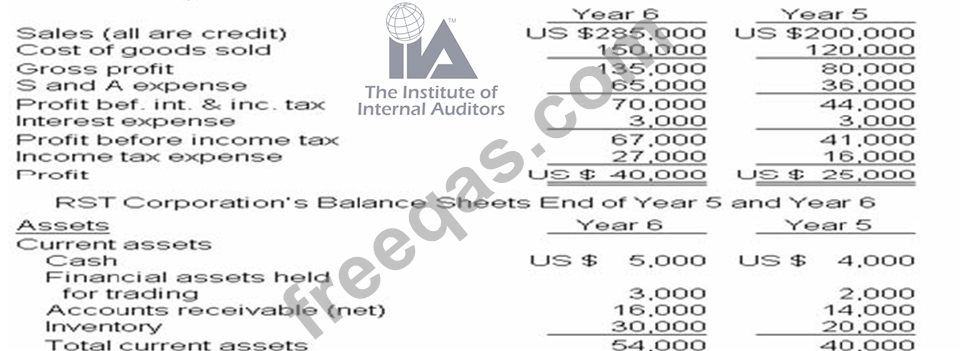

What is RST's acid-test or quick ratio at the end of Year 6?