Which of the following statements is true regarding the resolution of interpersonal conflict?

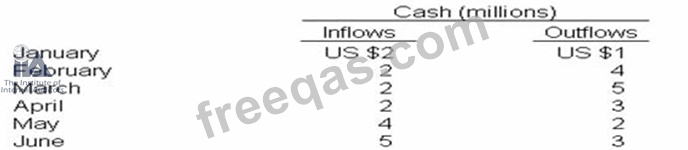

The treasury analyst for a manufacturing entity has estimated the cash flows for the first half of next year (ignoring any short-term borrowings) as follows:

The entity has a line of credit of up to US $4 million on which it pays interest monthly at a rate of 1% of the amount used. The entity is expected to have a cash balance of US $2 million on January 1, with no amount of its line of credit used. Assuming all cash flows occur at the end of the month approximately how much will the entity pay in interest during the first half of the year?

Which of the following lists best describes the classification of manufacturing costs?

Which of the following standards would be most useful in evaluating the performance of a customer- service group?

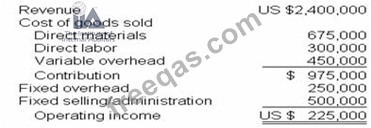

Barnes Corporation expected to sell 150,000 board games during the month of November. and the company's master budget contained the following data related to the sale and production of these games:

Actual sales during November were 180.000 games. Using a flexible budget, the company expects the operating income for the month of November to be: