A building contractor has a fixed-price contract to construct a large building. It is estimated that the building will take 2 years to complete. Progress billings will be sent to the customer at quarterly intervals. Which of the following describes the preferable point for revenue recognition for this contract if the outcome of the contract can be estimated reliably?

Which of the following statements is correct regarding risk analysis?

In forecasting purchases of inventory for a firm, all of the following are useful except:

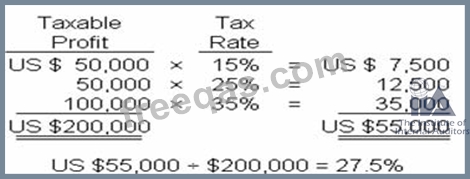

Based on its current operating levels Glucose LLC estimates that its annual level of taxable profit in the foreseeable future will be US $200,000 annually_ Enacted tax rates for the tax jurisdiction in which Glucose operates are 15% for the first US $50.000 of taxable profit.

25% for the next US $50.000 of taxable profit, and 35% for taxable profit in excess of US $100,000. Which tax rate should Glucose use to measure a deferred tax liability or asset?

Which of the following statements is true regarding a bring-your-own-device (BYOD) environment?