For employees, the primary value of implementing job enrichment is which of the following?

Which denominator used in the return on investment ROI) formula is criticized because it combines the effects of operating decisions made at one organizational level with financing decisions made at another organizational level?

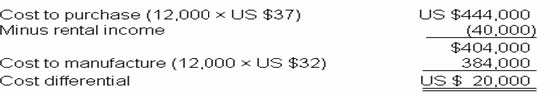

The ABC Company manufactures components for use in producing one of its finished products. When 12,000 units are produced, the full cost per unit is US $35, separated as follows: The XYZ Company has offered to sell 12,000 components to ABC for US $37 each. If ABC accepts the offer, some of the facilities currently being used to manufacture the components can be rented as warehouse space for US $40,000. However, US $3 of the fixed overhead currently applied to each component would have to be covered by ABC's other products. What is the differential cost to the ABC Company of purchasing the components from the XYZ Company?

Which of me following rs appfccaWe lo both a job order cost system and a process cost system?

What is the annual carrying cost, stated as a percentage of investment in inventory, that would be used in model?