A German importer of English clothing has contracted to pay an amount fixed in British pounds 3 months from now. lithe importer worries that the euro may depreciate sharply against the British pound in the interim, it would be well advised to:

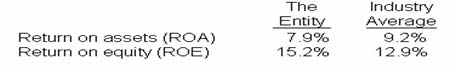

The following ratios relate to an entity's financial situation compared with that of its:

What conclusion could a financial analyst validly draw from these ratios?

Entity X owns 90% of entity Y. Early in the year, X lent Y U$110,000. No payments have been made on the debt by year-end. Proper accounting at year-end in the consolidated financial statements would:

If a just-in-time purchasing system is successful in reducing the total inventory costs of a manufacturing company, which of the following combinations of cost changes would be most likely to occur?

Which of the following statements about market signaling is correct?

1.The organization releases information about a new product generation.

2.The organization limits a challenger's access to the best source of raw materials or labor.

3.The organization announces that it is fighting a new process technology.

4.The organization makes exclusive arrangements with the channels.