U+ Bank's marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want to show offers on a customer's account page if the customer has already received three home loan offers in the last two weeks.

What do you need to define to implement the business requirement?

U+ Bank, a retail bank, uses Pega Customer Decision Hubtm for their one-to-one customer engagement. The bank now wants to change its offer prioritization to consider both business objectives and customer needs.

Which two factors do you configure in the Next-Best-Action Designer to implement this change? (Choose Two)

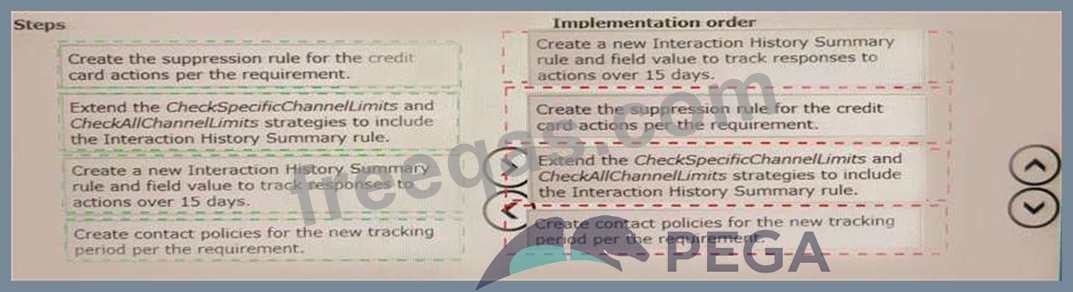

A financial institution wants to add a new tracking period to track its customers' response over 15 days in various channels. Once the response is tracked, they want to suppress the credit card actions if customers ignore it three times within 15 days.

Put the steps in the correct order to implement this task.

U+ Bank recently introduced a new credit card offer, Platinum Plus, for its premium customers. As the bank has some financial targets to meet, the business has decided to boost the Platinum plus card.

As a decisioning consultant, how can you ensure that the Platinum Plus offer is prioritized over other offers?

Using Pega Customer Decision Hub, a mobile company transitions from a one-to-many to a one-to-one marketing approach. The company is introducing a new data plan.

Which two channels can the company use to present the new data plan to a customer? (Choose Two)

Enter your email address to download Pegasystems.PEGAPCDC85V1.v2022-04-16.q20 Dumps