A newly promoted chief audit executive (CAE) is faced with a backlog of assurance engagement reports to review for approval. In an attempt to attach a priority for this review, the CAE scans the opinion statement on each report. According to IIA guidance, which of the following opinions would receive the lowest review priority?

1. Graded positive opinion.

2. Negative assurance opinion.

3. Limited assurance opinion.

4. Third-party opinion.

Management would like to self-assess the overall effectiveness of the controls in place for its 200-person manufacturing department. Which of the following client-facilitated approaches is likely to be the most efficient way to accomplish this objective?

Which of the following is a detective control strategy against fraud?

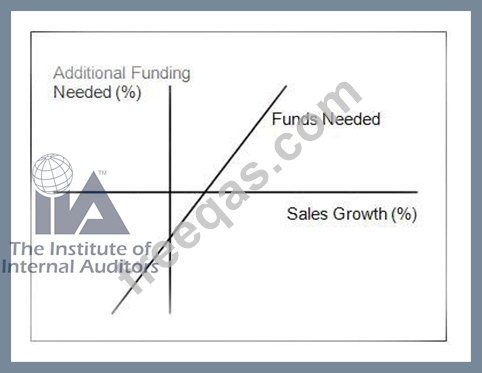

Refer to the exhibit.

If the profit margin of an organization decreases, and all else remains equal, which of the following describes how the "Funds Needed" line in the graph below will shift?

An internal auditor who is carrying out an engagement to review controls related to corporate tax reporting must possess which of the following competencies?

1. Proficiency in analyzing key IT risks and controls.

2. The ability to recognize significant deviations from good business practices.

3. Knowledge of key indicators of fraud in tax reporting.

4. The ability to recognize the existence of problems related to tax accounting.