Price skimming involves:

A value-added tax is collected on the basis of:

An entity experienced sales of US $5 billion, profit before interest and taxes of US $200 million, profit before taxes of US $100 million, and profit of US $70 million. Based on this information and the entity's balance sheet information in Exhibit A. the return on equity ROE is: \

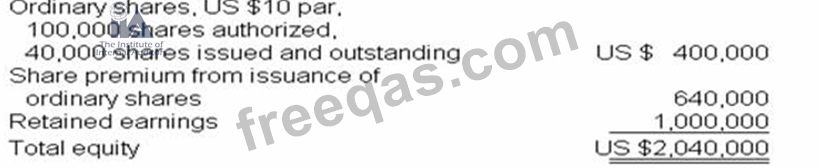

At December 31, Year 1, an entity had the following equity accounts:

Each of the 40,000 ordinary shares outstanding was issued at a price of US $26. On January 2, Year 2, 2,000 shares were reacquired for US $30 per share. The cost method is used in accounting for these treasury shares. Which of the following correctly describes the effect of the acquisition of the treasury shares?

Companies that adapt just-in-time purchasing systems often experience