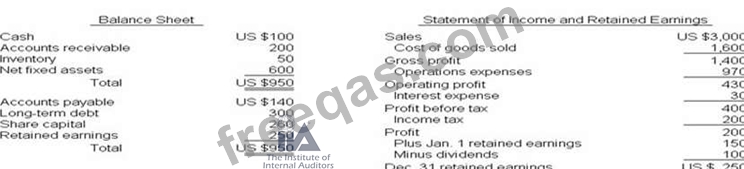

A condensed comparative balance sheet for an entity appears below:

In looking at liquidity ratios at both balance sheet dates, what happened to the 1) current ratio and 2) acid-test (quick) ratio?

Which of the following is the most appropriate test to assess the privacy risks associated with an organization's workstations?

Which of the following results in a tax base of zero?

Without prejudice to your answer to any other question, assume that cost of goods sold for the current year ended December 31 is 2,000,000. Inventory turnover on total inventory for the entity would be:

What is the expected average collection period for the entity?