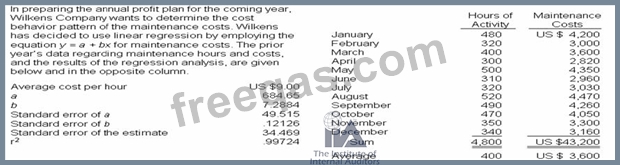

Based upon the data derived from the regression analysis, 420 maintenance hours in a month would mean the maintenance costs rounded to the nearest U dollar) would be budgeted at

Debtor Bank on a 10-year, 15% note in the amount of US $100,000, plus US $30,000 accrued interest. Because if financial difficulty. Debtor has been unable to make annual interest payments for the past 2 years and the n-ate is due today. Accordingly. Bank legally agreed to restructure

Debtor's debt as follows:

The US $30.000 of accrued interest was forgiven.

Debtor was given 3 more years to pay off the debt at 8% interest. Payments are to be made annually at year-end. The present value of the payments using the prevailing rate for similar instruments of an issuer with a similar credit rating is US $84.018.

At the date of the restructuring, Debtor properly records:

Overtime conditions and pay were recently set by the human resources department. The production department has just received a request for a rush order from the sales department. The production department protests that additional overtime costs will be incurred as a result of the order. The sales department argues that the order is from an important customer. The production department processes the order. To control costs, which department should never be charged with the overtime costs generated as a result of the rush order?

Which of the following best describes the chief audit executive's responsibility for assessing the organization's residual risk?