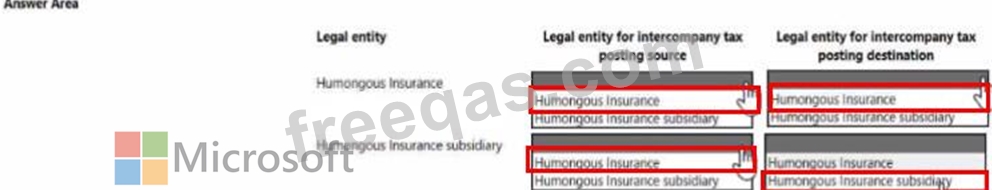

You need to configure expense management tor Humongous Insurance and its subsidiary. Which options should you use? To answer select the appropriate options in me answer area NOTE: Each correct selection is worth one point.

You are configuring taxes in Dynamics 365 Finance for a client.

Vendor invoices require a five percent sales tax calculation. Per government rules, the client can recover only

60 percent of this five percent sales tax amount against certain commodities. The remaining 40 percent is non-recoverable.

You need to configure the sales taxes to post to the expense account.

Where should you configure the sales tax percentage?

You are configuring the Accounts payable module for a company.

The company needs to set a limit on the charges they will pay for specific items.

You need to set up the limit for charges.

Which two actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

You are a functional consultant for Contoso Entertainment System USA (USMF).

You plan to run several reports in USMF that list all the write-off transactions.

You need to replace the write-off reason used by the system for USMF to use a reason of "Bad debts.

To complete this task, sign in to the Dynamics 365 portal.

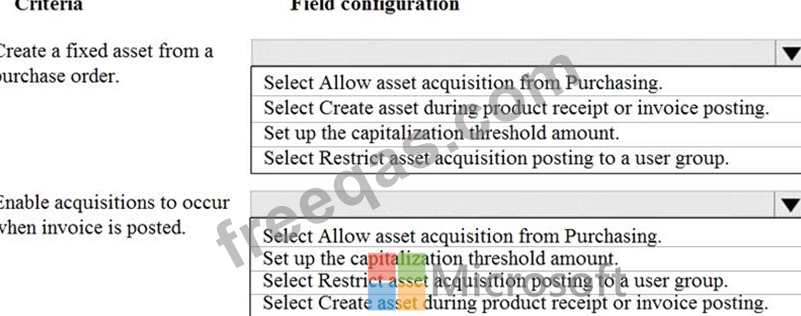

You are the purchase manager of an organization. You purchase a laptop for your office for $2,000. You plan to create a purchase order and acquire the new fixed asset through the purchase order at time of invoicing.

You set up the system as follows: Fixed assets are automatically created during product receipt or vendor invoice posting and the capitalization threshold for the computers group (COMP) is set to $1,600.

You need to automatically create a fixed asset record when you post an acquisition transaction for the asset after you post the invoice.

How should you configure the fixed asset parameters to meet the criteria? To answer, select the appropriate option in the answer area.

NOTE: Each correct selection is worth one point.