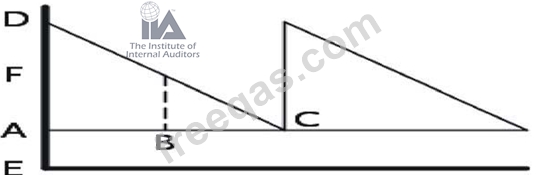

Which line segment represents the reorder lead time?

Refer to the exhibit.

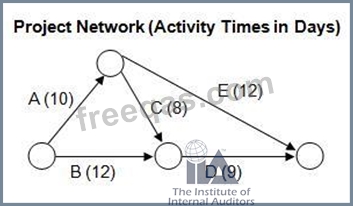

The figure below shows the network diagram for the activities of a large project. What is the shortest number of days in which the project can be completed?

Company M. which began operations on January 1, Year 1, recognizes income from long-term construction contracts under the percentage-of-completion method in its financial statements and under the completed-contract method for tax reporting. Income under each method follows:

There are no other temporary differences. If the applicable tax rate is 25% what amount should Company M report in its balance sheet at December 31, Year 3, for deferred income tax liability?

Finance and operating leases differ in that the lesser:

In November of the current year, the vice-president of a local bank reviews the bank's mortgage portfolio prior to the December 31 year-end. The bank's largest client has mortgages on buildings in three cities. The client has incurred net losses for the past 3 years and is now experiencing serious cash flow problems. For the past 6 months, no payments have been made on any of the three mortgages. The vice-president reluctantly concludes that it is probable that the full amount of principal and interest will not be collected. What is the impact of this conclusion on the local bank's current year financial statements?