In making a cash flow analysis of property, plant, and equipment PPE), the internal auditor discovered that depreciation expense for the period was US $10,000. PPE with a cost of US $50,000 and related accumulated depreciation of US $30,000 was sold for a gain of US $1.000. If the carrying amount of PPE increased by US $80,000 during the period, how much PPE was purchased this period?

Risoner Company plans to purchase a machine with the following conditions:

Purchase price = US $300,000

The down payment = 10% of purchase price with remainder financed at an annual interest rate of 16%. The financing period is 8 years with equal annual payments made every year.

The present value of an annuity of US $1 per year for 8 years at 16% is 4.3436.

The present value of US $1 due at the end of 8 years at 16% is 3050

The annual payment rounded is:

Project B's internal rate of return is closest to:

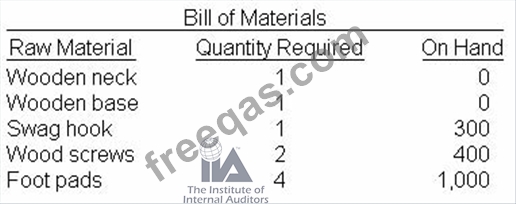

A company manufactures banana hooks for retail sale. The bill of materials for this item and the parts inventory for each material required are as follows:

An incoming order calls for delivery of 2.000 banana hooks in 2 weeks. The company has 200 finished banana hooks in current inventory. If no safety stocks are required for inventory, what are the company's net requirements for swag hooks and screws needed to fill this order?

A one-time password would most likely be generated in which of the following situations?