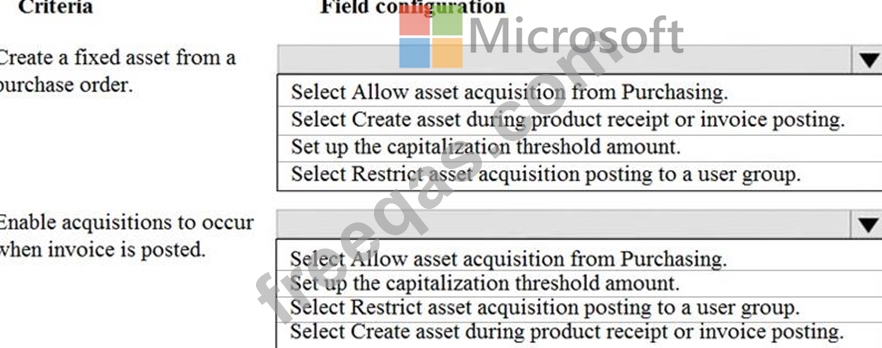

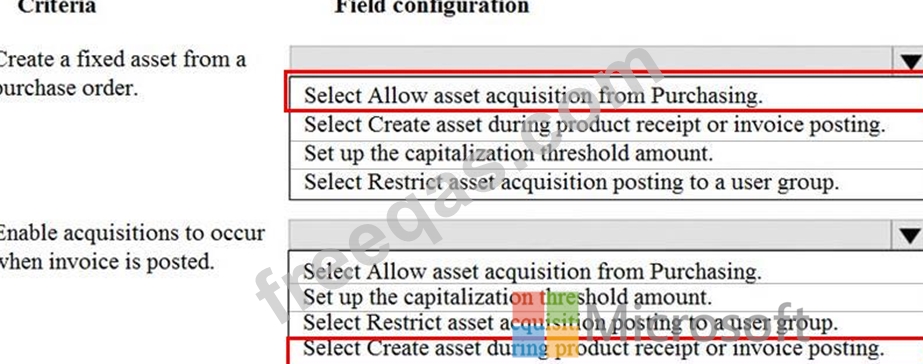

You are the purchase manager of an organization. You purchase a laptop for your office for $2,000. You plan to create a purchase order and acquire the new fixed asset through the purchase order at time of invoicing.

You set up the system as follows: Fixed assets are automatically created during product receipt or vendor invoice posting and the capitalization threshold for the computers group (COMP) is set to $1,600.

You need to automatically create a fixed asset record when you post an acquisition transaction for the asset after you post the invoice.

How should you configure the fixed asset parameters to meet the criteria? To answer, select the appropriate option in the answer area.

NOTE: Each correct selection is worth one point.

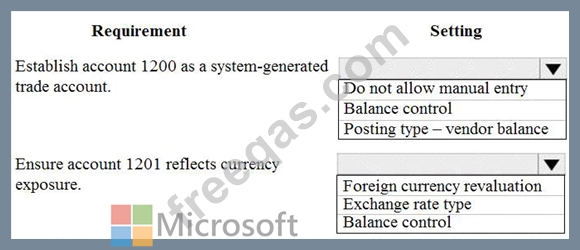

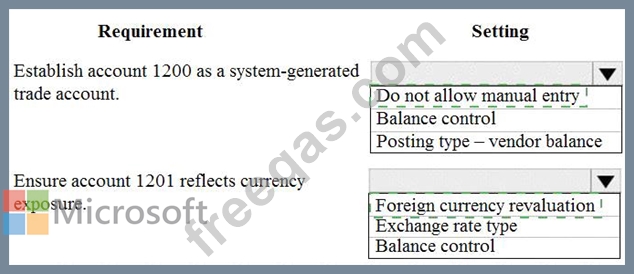

You work for a company that receives invoices in foreign currencies.

You need to configure the currency exchange rate providers and exchange rate types.

What should you do?

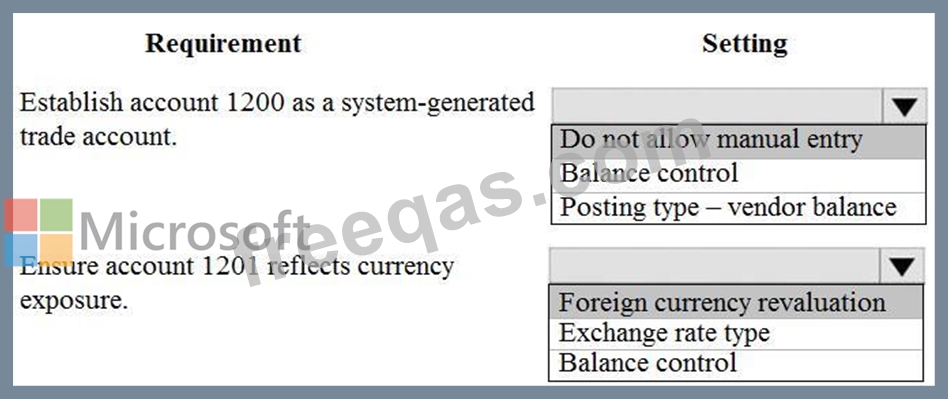

You need to configure settings to resolve User1's issue.

Which settings should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

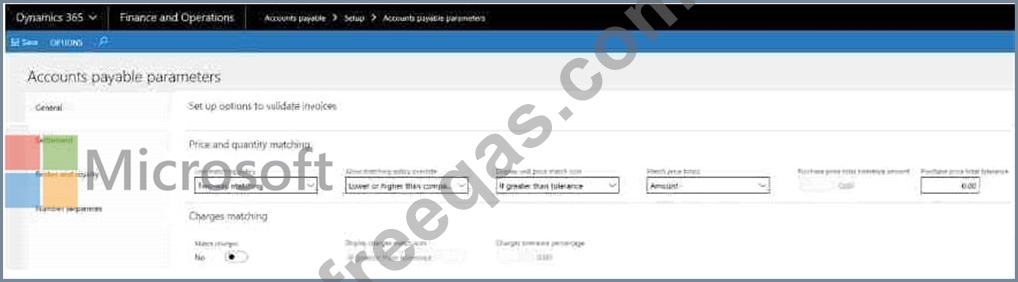

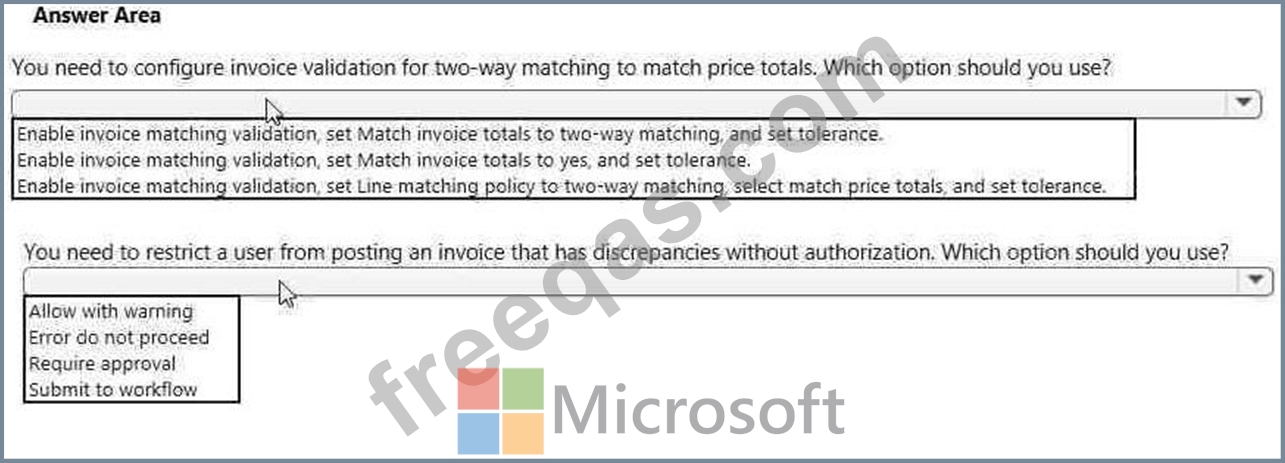

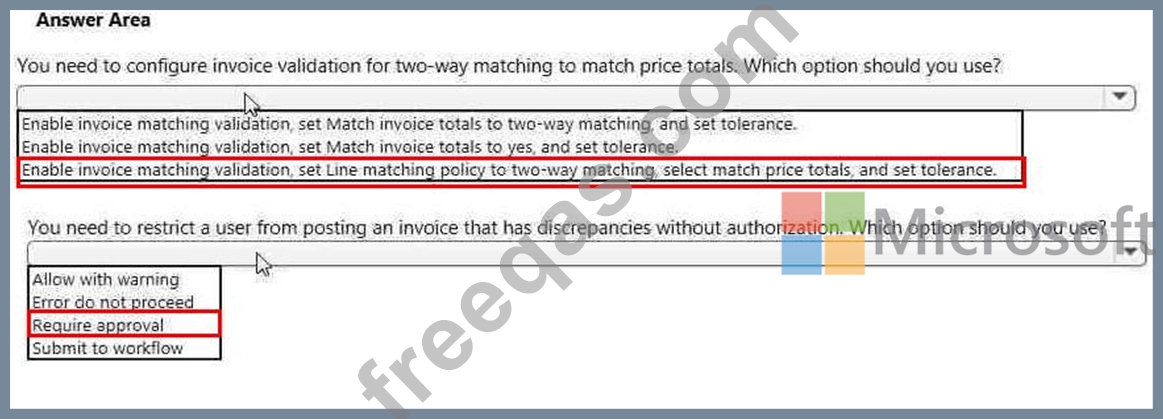

You need to configure invoice validation for vendors in Dynamics 365 for Finance and Operations. You are viewing the Accounts payable parameter for Invoice validation.

You need to configure the system to meet the fiscal year requirements. What should you do?