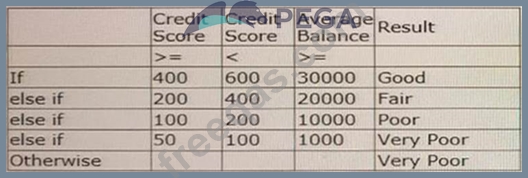

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to

accomplish this requirement in Pega Customer Decision Hub.

Which property allows you to use the risk segment computed by the decision table in the decision strategy?

U+ Bank has recently implemented a cross-sell on the web microjourney and is satisfied with the results. The bank now wants these Next-Best-Action recommendations to be delivered via outbound communication channels. Select two outbound channels that U+ bank can use to deliver Next-Best-Action recommendations.

(Choose Two).

MyCo, a telecommunications company, wants to implement one-to-one customer engagement using Pega Customer Decision Hub. Which of the following real-time channels can the company use to present Next-Best-Actions? (Choose Three)

U+ Bank recently introduced a new credit card offer, Platinum Plus, for its premium customers. As the bank has some financial targets to meet, the business has decided to boost the Platinum plus card.

As a decisioning consultant, how can you ensure that the Platinum Plus offer is prioritized over other offers?

HOTSPOT

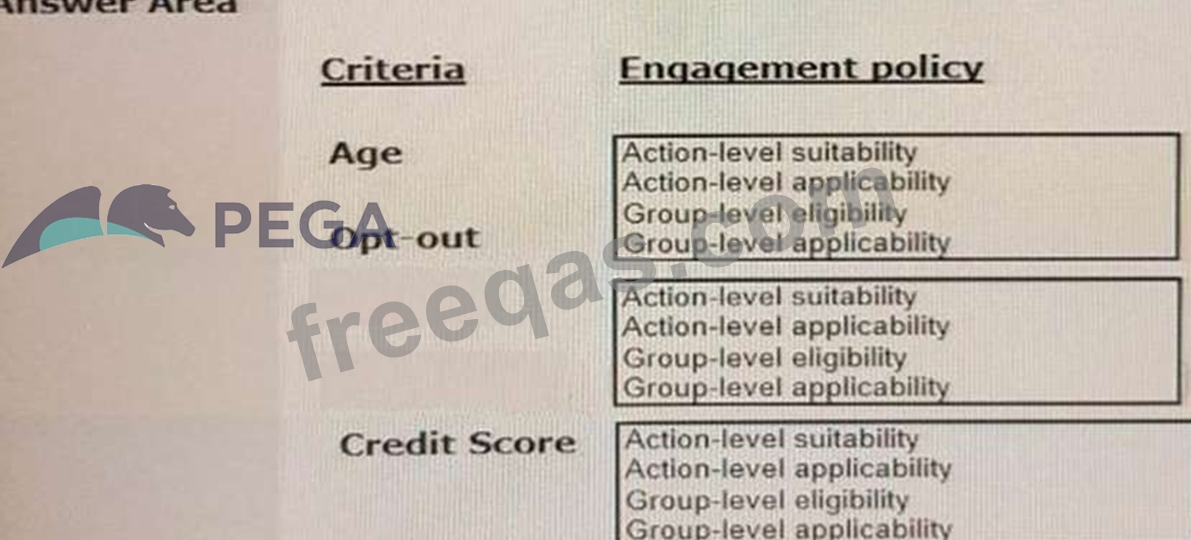

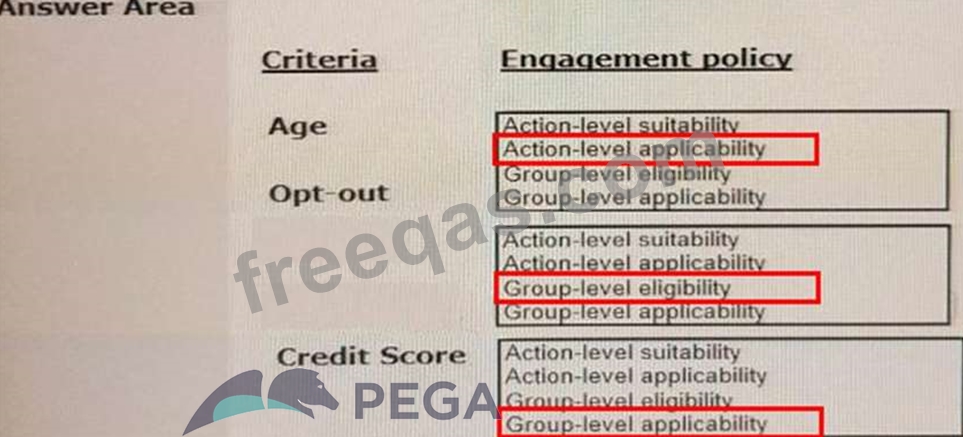

U+ Bank, a retail bank, has introduced a credit cards group with Gold card and Platinum card offers.

The bank wants to present these two offers based on the following criteria:

1. For both cards, customers must be above the age of 18

2. Offer both cards only if the customer does not explicitly opt-out of any direct marketing for credit cards

3. Platinum card is suitable for customers with the Credit Score > 500

As a decisioning consultant, how do you implement this requirement? In the Answer Area, select the correct engagement policy for each criterion.

Enter your email address to download Pegasystems.PEGAPCDC87V1.v2023-05-23.q71 Dumps