U+ Bank promotes credit card offers on its website and uses Pega Customer Decision Hub to personalize the offer for every customer. Now, the bank wants to lower the number of customers that leave the bank by showing a proactive retention offer to high churn risk customers instead. As an NBA analyst, you are tasked with creating a new applicability setting to comply with the new business rule. Which business issue or issues do you modify?

A bank has several credit card offers defined under the sales issue / credit card group. The card_type action property for some of the cards is set to VISA and for others to Mastercard. The bank wants to limit the total number of VISA cards sent via email in an outbound run. How do you implement this requirement?

U+ Bank wants to offer a 10% discount for customers whose CLV value is higher than 400. Which strategy component should you use to meet the new requirement?

A bank wants to automatically pause actions that are shown too often for a specific time period. Which rules do you need to define?

MyCo, a mobile company, uses Pega Customer Decision Hub to display offers to customers on its website.

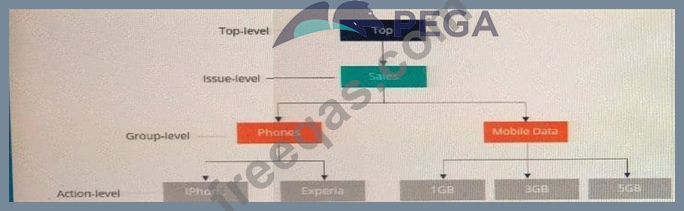

The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning consultant, what must you do to present offers from the two groups?

Enter your email address to download Pegasystems.PEGAPCDC87V1.v2023-05-23.q71 Dumps